Clark Wealth Partners for Dummies

Wiki Article

The 5-Second Trick For Clark Wealth Partners

Table of ContentsThe Main Principles Of Clark Wealth Partners A Biased View of Clark Wealth PartnersNot known Details About Clark Wealth Partners The 7-Minute Rule for Clark Wealth Partners4 Easy Facts About Clark Wealth Partners ExplainedThe 8-Minute Rule for Clark Wealth PartnersThe 8-Second Trick For Clark Wealth PartnersThe Only Guide for Clark Wealth Partners

Usual reasons to think about an economic consultant are: If your financial situation has actually become a lot more complex, or you lack self-confidence in your money-managing abilities. Conserving or navigating significant life occasions like marriage, separation, children, inheritance, or task adjustment that may substantially affect your monetary situation. Navigating the transition from conserving for retired life to preserving wealth during retirement and how to create a solid retired life earnings plan.New innovation has actually caused more extensive automated economic tools, like robo-advisors. It's up to you to explore and identify the ideal fit - https://www.easel.ly/browserEasel/14614718. Inevitably, a great economic consultant must be as mindful of your financial investments as they are with their very own, avoiding extreme fees, saving money on tax obligations, and being as clear as possible about your gains and losses

Clark Wealth Partners Can Be Fun For Everyone

Gaining a compensation on item recommendations does not always mean your fee-based advisor functions versus your ideal passions. They may be more inclined to advise items and solutions on which they gain a payment, which may or may not be in your finest passion. A fiduciary is lawfully bound to put their client's passions first.They may follow a loosely kept an eye on "viability" standard if they're not signed up fiduciaries. This standard enables them to make suggestions for investments and solutions as long as they suit their customer's goals, threat tolerance, and monetary scenario. This can translate to suggestions that will certainly additionally earn them cash. On the other hand, fiduciary advisors are legitimately bound to act in their client's ideal passion instead of their own.

The smart Trick of Clark Wealth Partners That Nobody is Discussing

ExperienceTessa reported on all points spending deep-diving into complex economic subjects, clarifying lesser-known financial investment avenues, and uncovering ways viewers can work the system to their advantage. As an individual money professional in her 20s, Tessa is acutely knowledgeable about the impacts time and uncertainty have on your financial investment decisions.

It was a targeted promotion, and it functioned. Find out more Read much less.

The Greatest Guide To Clark Wealth Partners

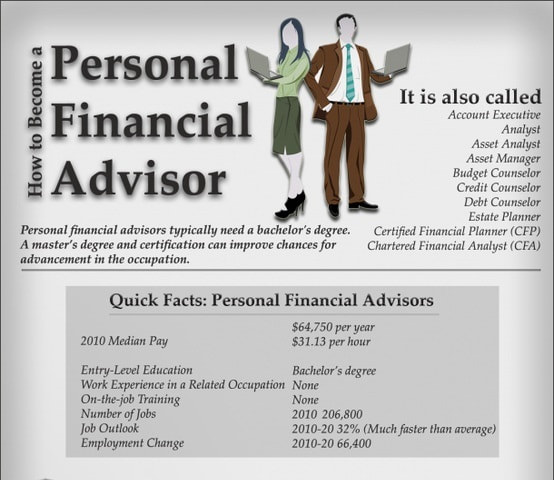

There's no single path to coming to be one, with some people beginning in banking or insurance coverage, while others start in accounting. A four-year level offers a solid structure for jobs in investments, budgeting, and customer solutions.

Clark Wealth Partners Can Be Fun For Everyone

Typical examples include the FINRA Series 7 and Collection 65 exams for safety and securities, or a state-issued insurance policy certificate for marketing life or medical insurance. While qualifications may not be legally needed for all preparing duties, employers and customers typically watch them as a benchmark of professionalism and reliability. We check out optional credentials in the following area.The majority of economic planners have 1-3 years of experience and familiarity with monetary products, compliance standards, and straight customer interaction. A solid instructional history is necessary, yet experience shows the ability to apply concept in real-world settings. Some programs combine both, allowing you to complete coursework while gaining supervised hours via internships and practicums.

Fascination About Clark Wealth Partners

Very early years can bring long hours, pressure to build a customer base, and the requirement to continuously show your experience. Financial organizers take pleasure in the possibility to function carefully with clients, overview important life decisions, and usually accomplish versatility in timetables or self-employment.

They spent much less time on the client-facing side of the market. Nearly all economic supervisors hold a bachelor's degree, and several have an MBA or similar graduate degree.

The Only Guide to Clark Wealth Partners

Optional accreditations, such as the CFP, normally require added coursework and screening, which can expand the timeline by a number of years. According to the Bureau of Labor Data, personal financial experts make a mean annual annual income of $102,140, with leading earners earning over $239,000.In other districts, there are regulations that need them to satisfy certain requirements to utilize the monetary consultant or monetary planner titles (financial advisor st. louis). What establishes some financial consultants in addition to others are education, training, experience and credentials. There are several classifications for monetary advisors. For monetary planners, there are 3 usual designations: Licensed, Personal and Registered Financial Coordinator.

What Does Clark Wealth Partners Mean?

Those on income may have an incentive to advertise the services and products their employers supply. Where to discover a financial advisor will certainly rely on the kind of suggestions you require. These organizations have personnel who might aid you comprehend and get certain sorts of financial investments. Term deposits, guaranteed investment certificates (GICs) and mutual funds.Report this wiki page